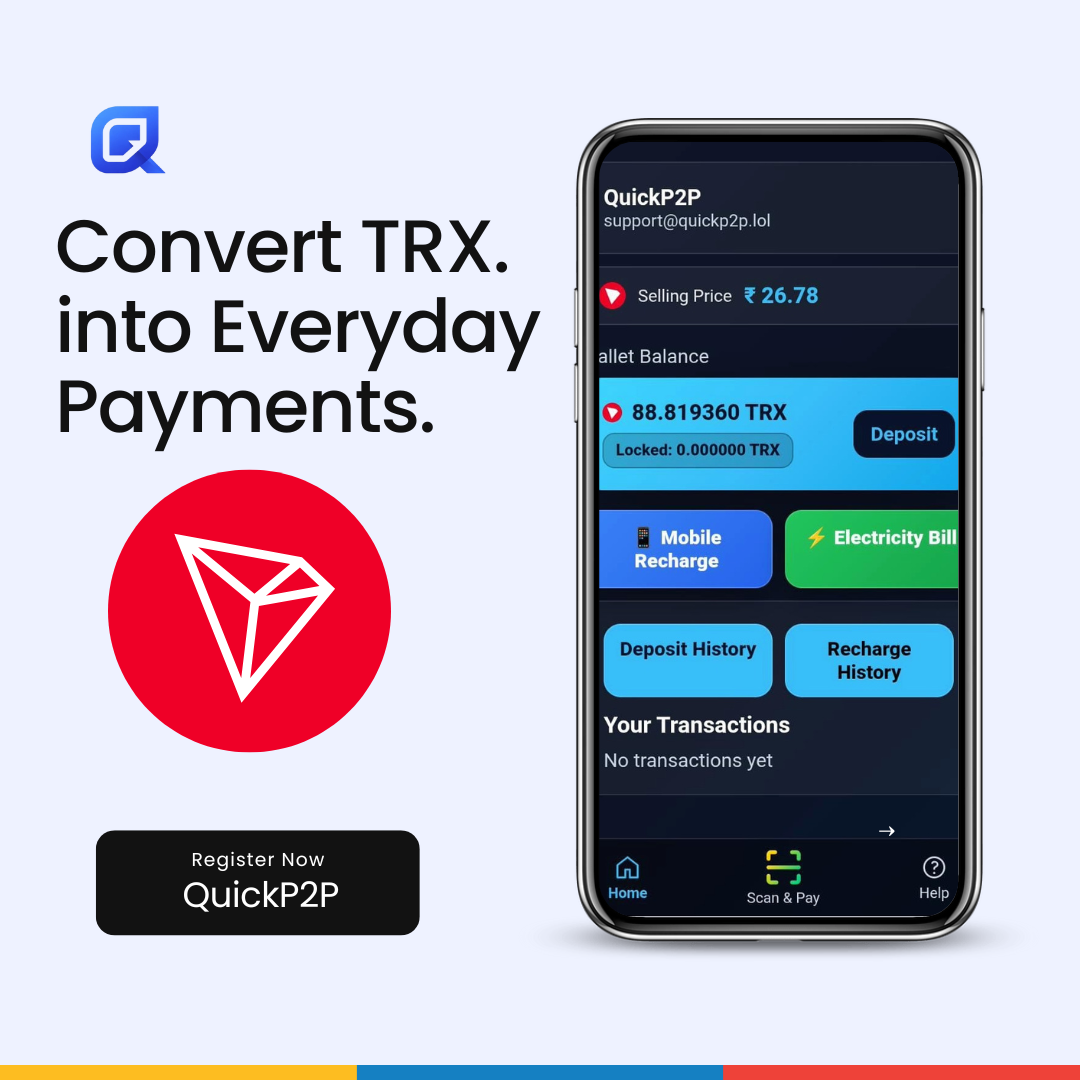

A platform enabling UPI payments, mobile recharges, and electricity bill payments across India using blockchain technology on the TRON network.

India’s decentralized crypto-powered payment network

Swap TRX directly for UPI payments, mobile recharges and electricity bills through a decentralized, blockchain-secured protocol.

Your transactions are protected by blockchain security. No sensitive data is shared, ensuring privacy-first P2P payments.

Near-instant TRX to INR settlement powered by a distributed network of liquidity providers.

Quickp2p runs without central control. You retain full ownership of your crypto at every step.

Pay any UPI, recharge any mobile number, or clear electricity bills seamlessly across India.

Everything you need to know about Quickp2p